estate tax change proposals 2021

Both pieces of legislation could have significant impacts for middle. Single With No Children Standard deduction increases from 6350 to 12550.

Estate Tax Law Changes What To Do Now

This comment explores the various proposals Congress has considered with a special emphasis on the interaction of estate tax on state revenue and philanthropy.

. The estate and gift tax rate and exemption would go back to 2009 levels making more gifts and estates fall under the higher tax rate. Economic Development Planning 124 West Diamond Street PO Box 1208 Butler PA 16003-1208 Phone. Americans were on the move in 2021 and they chose low-tax states over high-tax ones.

Persons other than lessors of residential real estate must file applicable Annual Business Tax Returns if they were engaged in business in San Francisco in 2021 as defined in Code section 62-12 qualified by Code sections 9523 f and g and are not otherwise exempt under Code sections 954 2105 and 2805 unless their combined taxable gross receipts in the City. The estate tax in the United States is a federal tax on the transfer of the estate of a person who dies. Here are three examples comparing the tax breaks from the 2021 tax year to the 2017 tax year before the TCJA enactment.

President Bidens Tax Proposals. Thats the finding of recent US. This change would accelerate the return to a top income tax bracket of 396 rather than waiting until tax years following 2025.

Increased tax hampers the affordability of mobile service which is a crucial. The tax rate applicable to transfers above the exemption is currently 40. Krista Swanson Gary Schnitkey Carl Zulauf and Nick Paulson Krista Swanson The US.

Line 17 Withholding Form 592-B andor 593 Enter the 2021 nonresident or real estate withholding credit from Forms 592-B Resident and Nonresident Withholding Tax Statement or Form 593. Enter the total amount of estimated tax payments made during the 2021 taxable year on this line. A proposed increase in the top ordinary income tax rate from 37 to 396 would be effective starting with the 2022 tax year.

The current exemption doubled under the Tax Cuts. Congress is debating two sets of new legislation that would impact the tax on farmer estates and inherited gains indicative of the momentum for changes to the current code for estate gifts and generation skipping taxes. What is the gift tax annual exclusion amount for 2022.

This rate is subject to change annually. Check back throughout 2021 for a snapshot of the current tax debate and explore our in-depth analysis of President Bidens FY 2022 budget proposals to learn more about its economic and fiscal impact. On November 10 2021 the IRS announced that the 2022 transfer tax exemption amount is 12060000 10000000 base amount plus an inflation adjustment of 2060000.

Line 16 2021 Estimated Tax. The tax rate is set by City Council and decided upon each year in April. 116KB List of delinquent real estate taxes for the City of Harrisonburg years 2018-2019 and 2019-2020.

Population only grew by 01 percent between July 2020 and July 2021 the lowest rate since the nations. 509300 452700 and 481000 respectively. WAVES 1350 No Change 000 0.

What is the transfer tax exemption for 2022. 20 Estate taxes reduce the value of an estate before its given to any heirs and the gift tax applies to gifts of money or property of more than 15000 in value Biden would change that to the 2009 level of. This includes the total value of personal assets including cash bank deposits real estate assets in insurance and pension plans ownership of unincorporated businesses financial securities and personal trusts a one-off levy on wealth is a.

Census Bureau population data along with commercial datasets released this week by U-Haul and United Van Lines. Individual Top Marginal Income Tax Rate Increase. The estate or trust uses Schedule K-1 541 to report your share of the estates or trusts income deductions credits etc.

The size of the estate tax exemption meant that a mere 01 of estates filed an estate tax return in 2020 with only about 004 paying any tax. Act 2021 the rate of withholding tax increased from 10 percent to 15 percent. Your name address and tax identification number as well as the estates or trusts name address and tax identification number should be entered on the Schedule K-1 541.

A wealth tax also called a capital tax or equity tax is a tax on an entitys holdings of assets. The tax rate for the City of Harrisonburg is 90 cents per hundred of assessed value effective July 1 2021 to June 30 2022. 40 2022 1206 million.

Concept Proposal Template Apple Iwork Pages Templates Forms Checklists For Ms Office And Apple Iwork Proposal Templates Proposal Concept

Special Report Common Agricultural Policy Cap And Climate

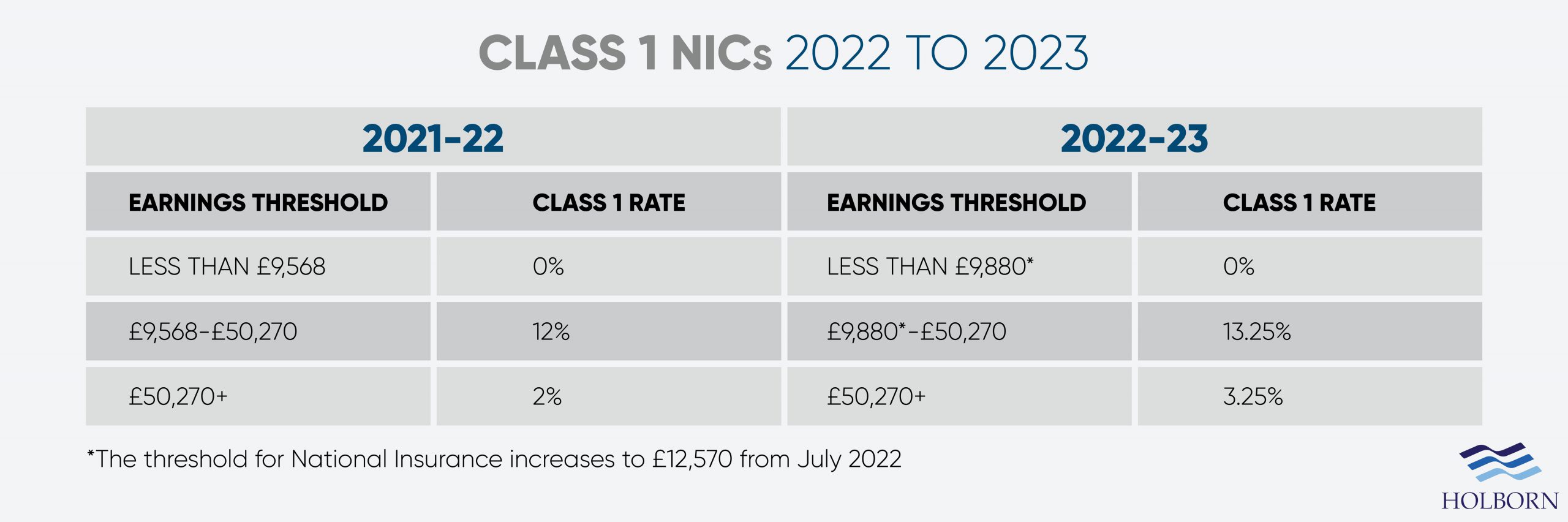

Changes To Uk Tax In 2022 Holborn Assets

Biden S Proposed 39 6 Top Tax Rate Would Apply At These Income Levels

A Closer Look At 2021 Proposed Tax Changes Charlotte Business Journal

Digital Activity Report 2020 2021

Will Joe Biden S Proposed Taxes On Capital Make America An Outlier The Economist

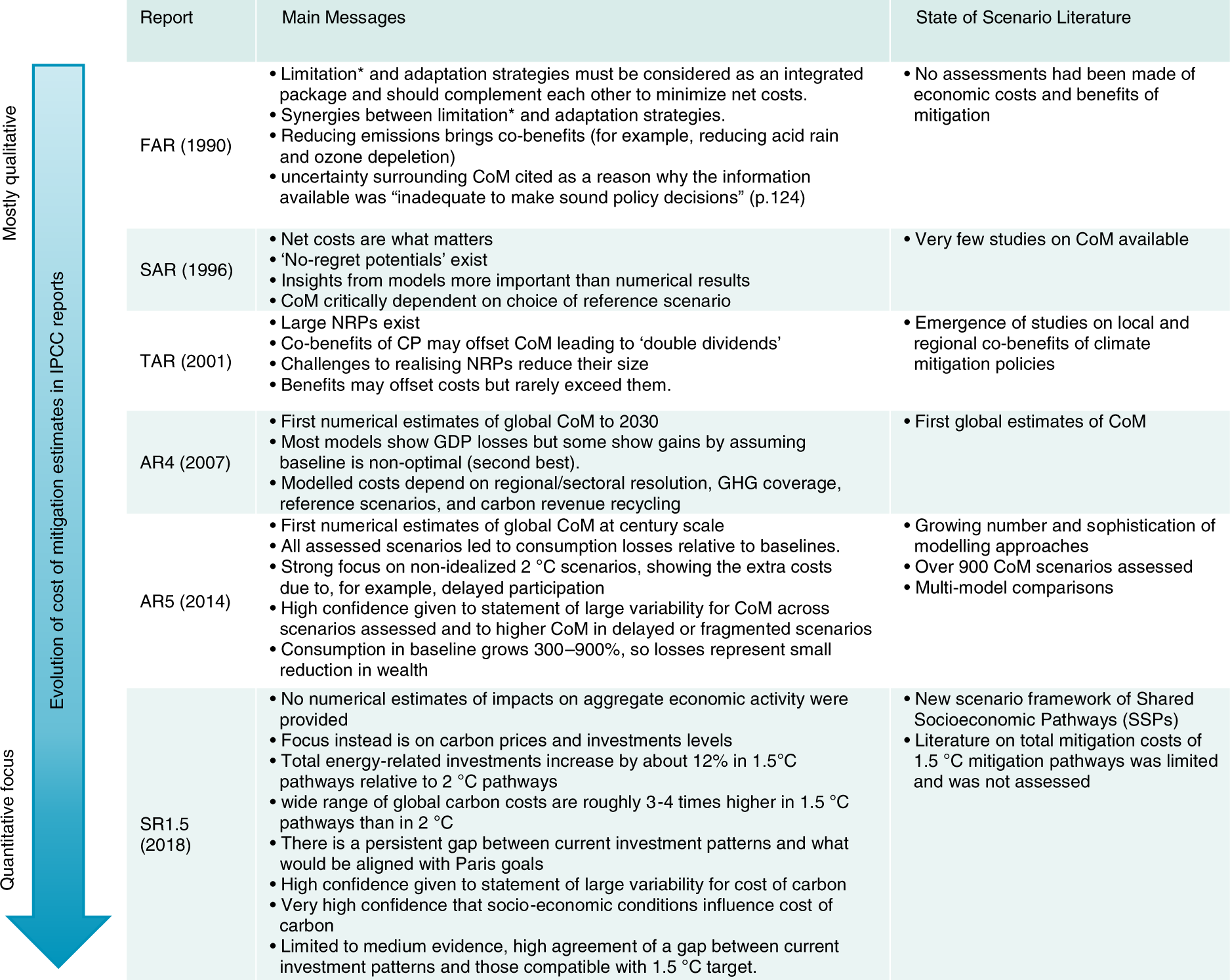

The Cost Of Mitigation Revisited Nature Climate Change

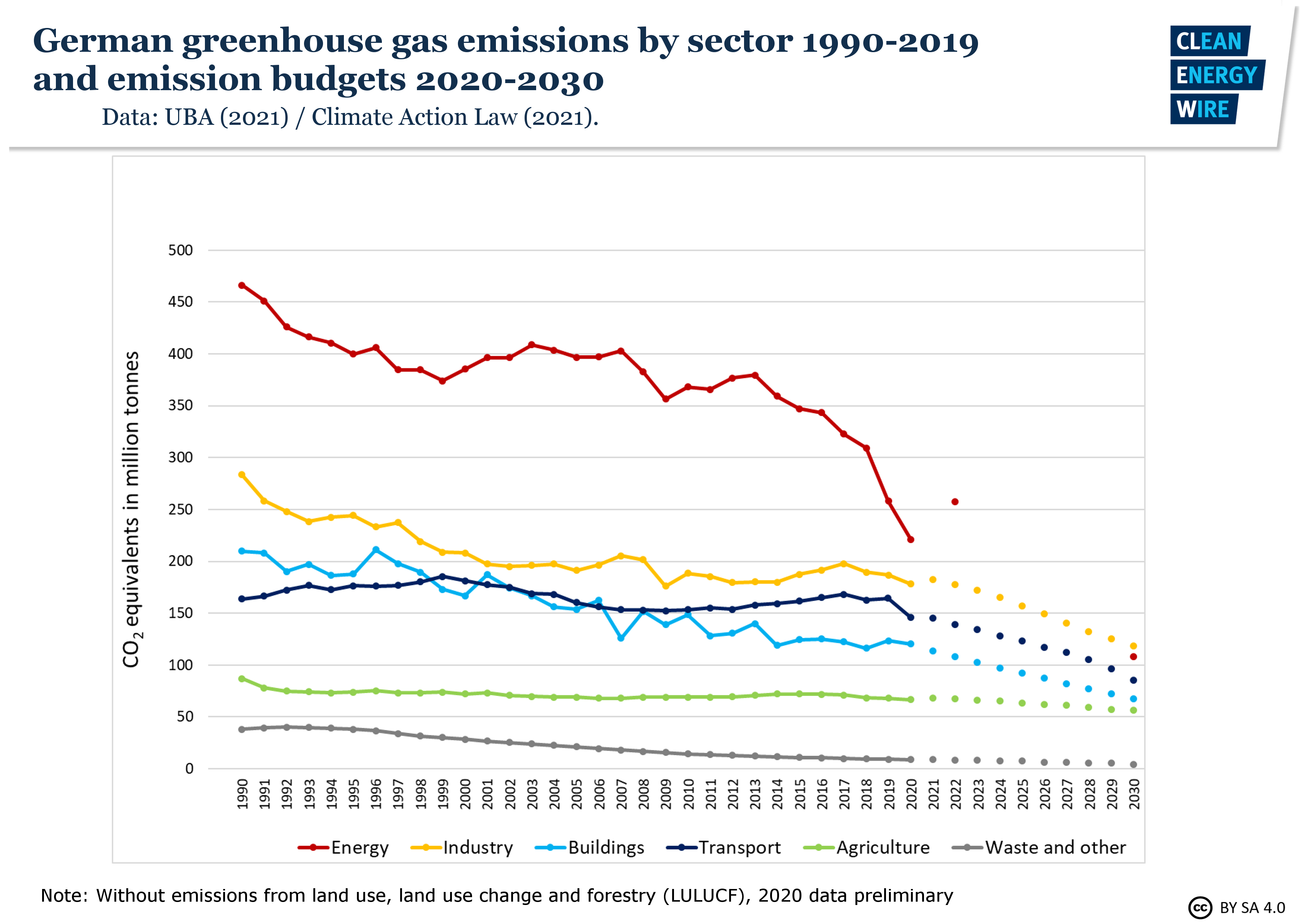

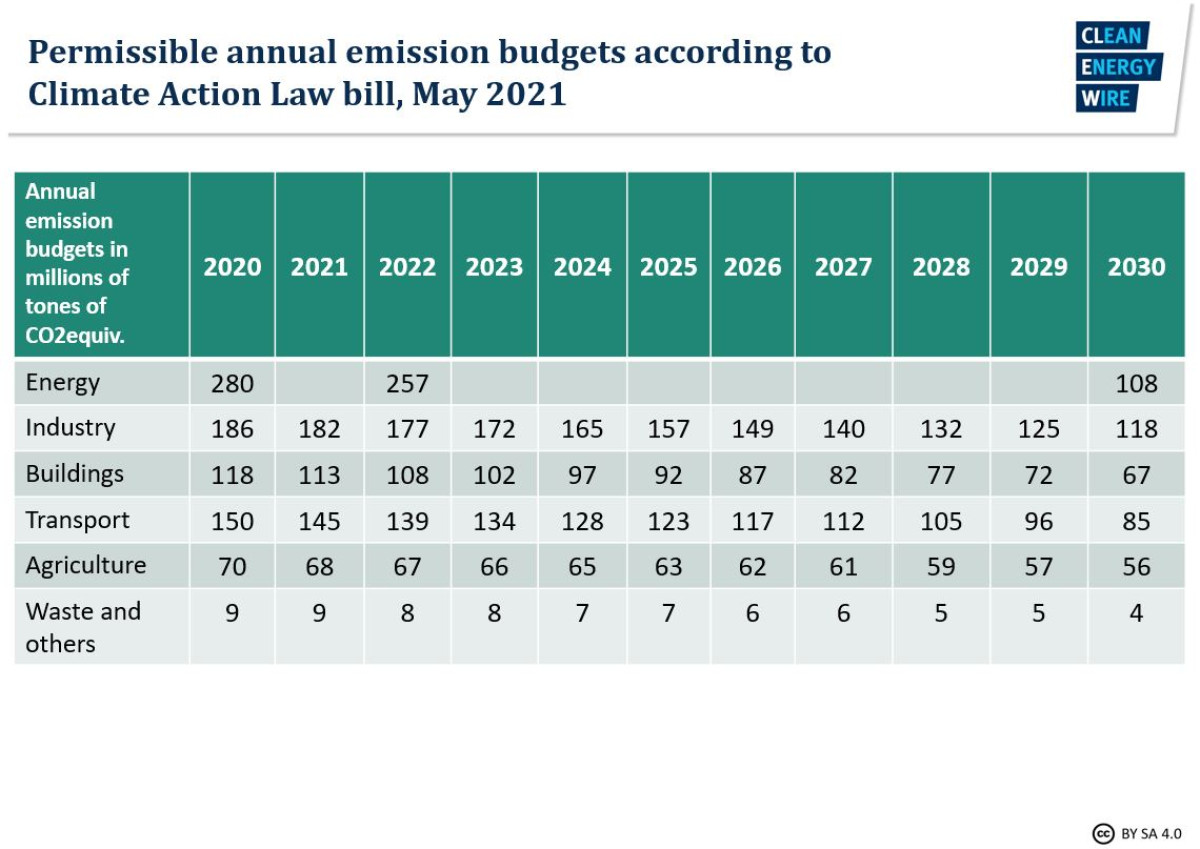

Germany S Climate Action Law Clean Energy Wire

Tax Increase Talk Prompts Wealthy To Splurge On Muni Bonds Bond Funds Corporate Bonds How To Raise Money

/cdn.vox-cdn.com/uploads/chorus_asset/file/22749561/GettyImages_1310860592_copy_2.jpg)

The Degrowth Movement To Fight Climate Change Explained Vox

House Democrats Tax On Corporate Income Third Highest In Oecd

Special Report Common Agricultural Policy Cap And Climate

Germany S Climate Action Law Clean Energy Wire

Unprecedented Changes Proposed To Gift And Estate Tax Laws Barnes Thornburg

The New Death Tax In The Biden Tax Proposal Major Tax Change