according to the trial balance what is the working capital cash 10 000

Calculate the Capital Balance and prepare a Trial Balance in chart of accounts order from the figures given. Tom began the year with a capital balance of 100000.

The Trial Balance Principlesofaccounting Com

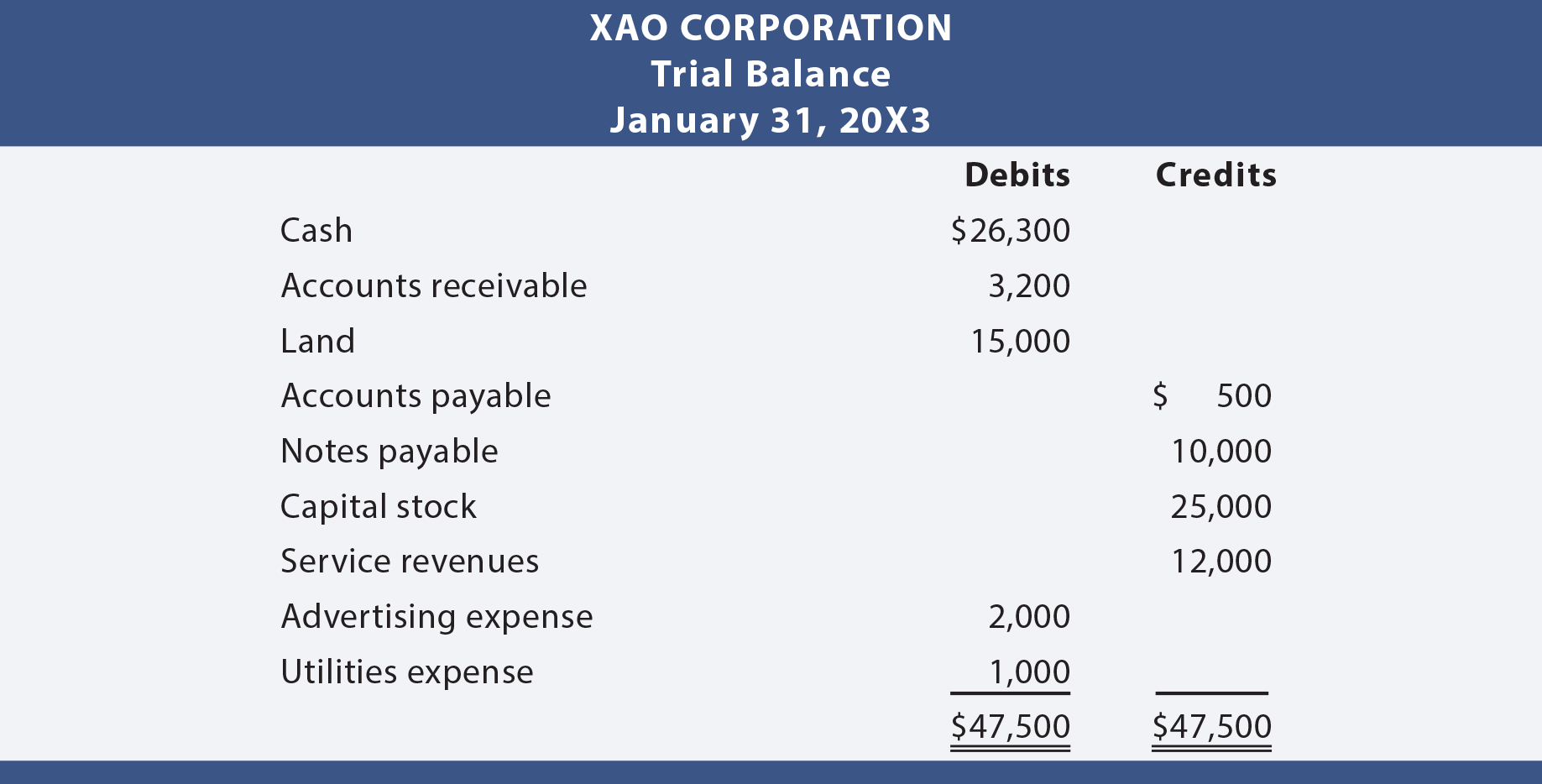

A trial balance is a report that lists the balances of all general ledger accounts of a company at a certain point in time.

. The companys balance of cash does not reflect a bank service fee of35 and interest earned on the checking account of 46. It is the job of the bookkeeper to make sure that it is in balance and that there are no abnormal values within the respective types of accounts. Cash AR Revenue d.

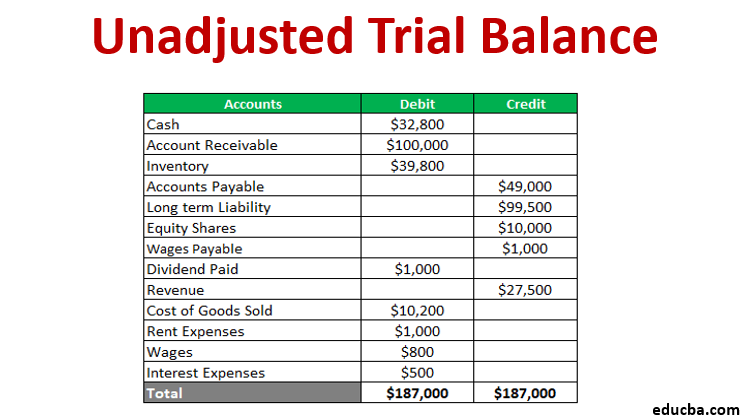

The unadjusted trial balance is created by transferring the accounts and. Working capital is the amount of a companys current assets minus the amount of its current liabilities. What is Kevins share of a profit of 20 000.

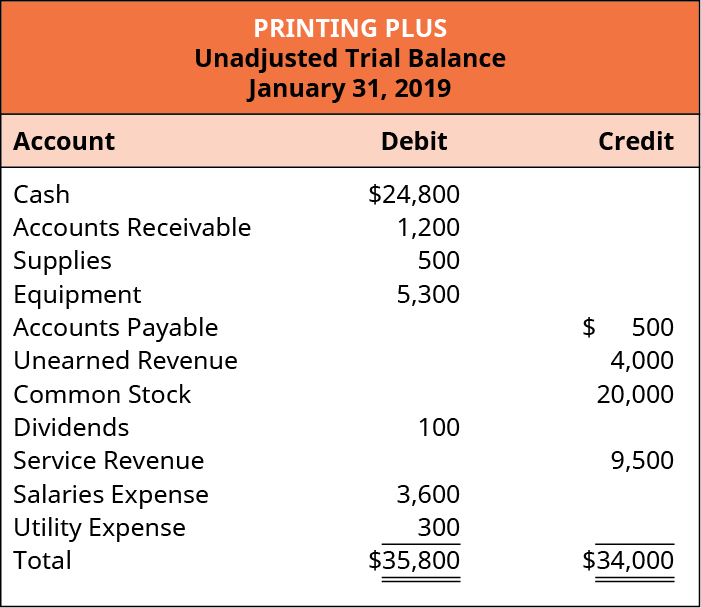

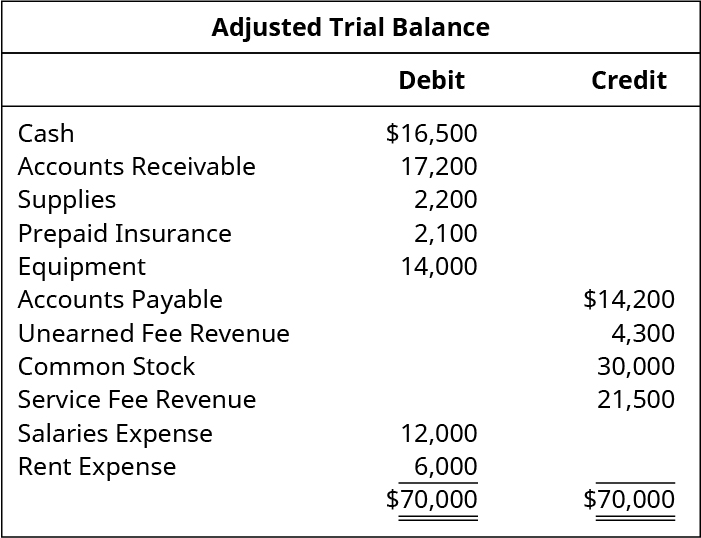

The following trial balance example combines the debit and credit totals into the second column so that the summary balance for the total is and should be zero. The primary report used by accountants is the trial balance. In The Adjustment Process we were introduced to the idea of accrual-basis accounting where revenues and expenses must be recorded in the accounting period in which they were earned or incurred no.

Once you have a completed adjusted trial balance in front of you creating the three major financial statementsthe balance sheet the cash flow statement and the income statementis fairly straightforward. Trial balance ensures that for every debit entry recorded a corresponding credit entry has been recorded in the books in accordance with the double entry concept of accounting. Cash is an asset and assets increase on the debit side.

The fundamental principle of double entry system is that at any stage the total of debits must be equal to the total of credits. The firm can borrow the funds for three years at 1080 percent interest per year. March 10 paid cash to purchase equipment 16000.

Types of Assets Common types of assets include current non-current physical intangible operating and non-operating. This lesson sums up the prior 15 lessons and illustrates the trial balance with a condensed version and an expanded version. Meaning of Trial Balance in Accounting.

Refer to the Chart of Accounts for exact wording of account titles. Do not insert the account numbers in the journal at this time. Lets assume that a companys balance sheet dated June 30 reports the following amounts.

It is a working paper that accountants use as a basis while preparing financial statements. 1 On the Working Trial Balance In column B. On January 23 2019 received cash payment in full from the customer on the January 10 transaction.

Cash is decreasing so total assets will decrease by 3600 impacting the balance sheet. As a result of this error the credit side total of the trial balance will be 1000 short. The capital of each is shown in the table above.

Levin began the year with a capital balance of 75000. The accounts reflected on a trial balance are related to all major accounting. Therefore the companys working.

Definition of Working Capital. Cash was received thus increasing the Cash account. Requires 600000 in financing over the next three years.

Journalize each of the May transactions in the two-column journal starting on Page 5 of the journal. A 4 000 B 5 000 C 6 000 D 8 000 2. Create a T-account for Cash post any entries that affect the account and calculate the ending balance for the account.

Example of Working Capital. Adjusting entries are added in the next column yielding an adjusted trial balance in the far right column. Accounting Comprehensive Problem 1.

Trial Balance acts as the first step in the preparation of financial statements. February 2 issued stock to shareholders for cash 25000. The ceo decides to do a forecast and predicts that if she utilizes short-term financing instead she will pay 750 percent interest in the first year 1215 percent interest in the second year and 825 percent interest in.

Negative working capital on a balance sheet typically means a company is not sufficiently liquid to pay its bills for the next 12 months and sustain growth. Total amount of current assets is 323000. As per the accounting cycle preparing a trial balance is the next step after posting and balancing ledger accountsIt is a statement of debit and credit balances that are extracted on a specific date.

Kern Capital 20 000 Keron Capital 30 000 Makesi Capital 30 000 Kevin Capital 20 000 Kern Keron Makesi and Kevin are partners sharing profits and losses in proportion to their capitals. However companies that enjoy a high inventory turnover and do business on a. Using information from the revenue and expense account sections of the trial balance you can create an income statement.

Net income for Levin-Tom partnership for 2009 was 125000. Cash AR Inventory - AE AP b. Prepare a bank reconciliation to calculate the correct ending balance of cash on August 31 2018.

Additional Information for 2009 follows. Incorrect inclusion towards ledger accounts Example that is at the end of the financial year while tallying the capital account credit amount of 9900 wrongly taken as 8900. Cash AR Inventory - AE c.

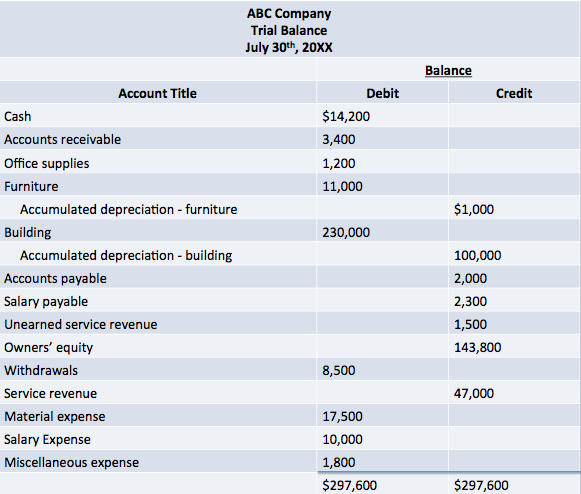

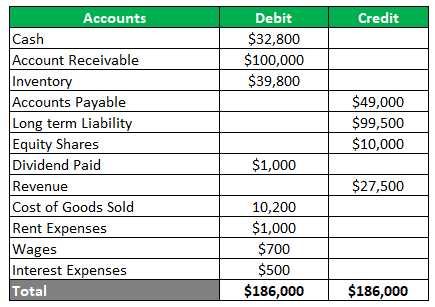

Trial Balance Cash 10000 Accounts Receivable 2000 Inventory 3000 Accounts Payable AP 2000 Accrued Expenses AE 3000 Revenue 15000 a. 27 Apply the Results from the Adjusted Trial Balance to Compute Current Ratio and Working Capital Balance and Explain How These Measures Represent Liquidity. Cash at Bank 9850.

Assume a Cash beginning balance of 16333. These amounts are included in the balance of cash of6042 reported by the bank as of the end of August. Levin and Tom have agreed to distribute partnership net income according to the following plan.

It is made as an attempt to prove that the total of ledger accounts with a debit balance is equal to the total of ledger accounts with the credit. Cash AR Inventory e. On the sheet called Working Trial Balance you will find the working trial balance for SNIFFER as of the end of the 1st quarter.

Trial balance may be defined as an informal accounting schedule or statement that lists the ledger account balances at a point in time compares the total of debit balance with the total of credit balance. This is the information you will use to complete the following tasks. According to the trial balance what is the working capital.

Total amount of current liabilities is 310000. An unadjusted trial balance is created first and used to make adjusted entries close the books and prepare the final versions of the financial statements. A trial balance is a financial statement that a business prepares at the end of an accounting period just before making adjusting entries.

Unadjusted Trial Balance Format Uses Steps And Example

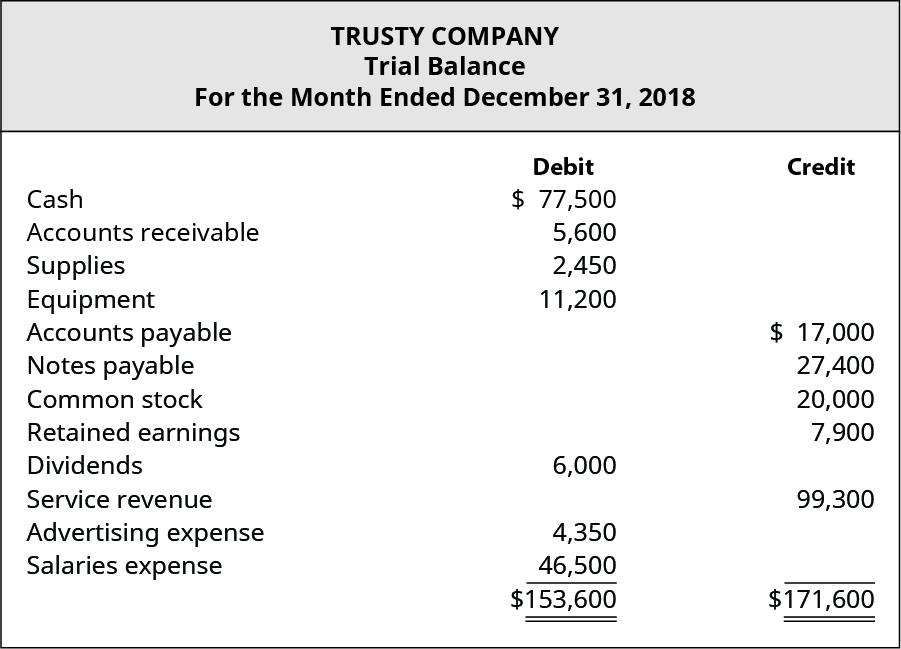

Prepare A Trial Balance Principles Of Accounting Volume 1 Financial Accounting

Unadjusted Trial Balance Format Uses Steps And Example

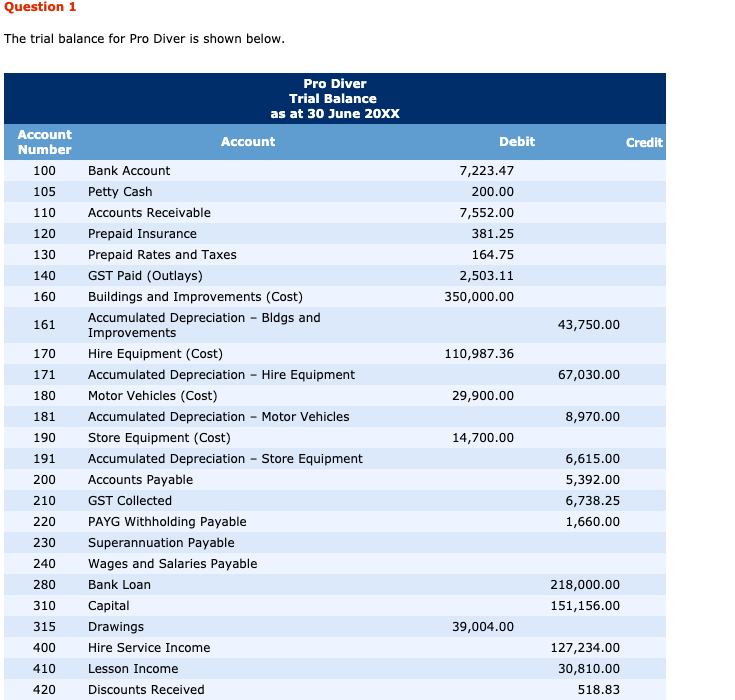

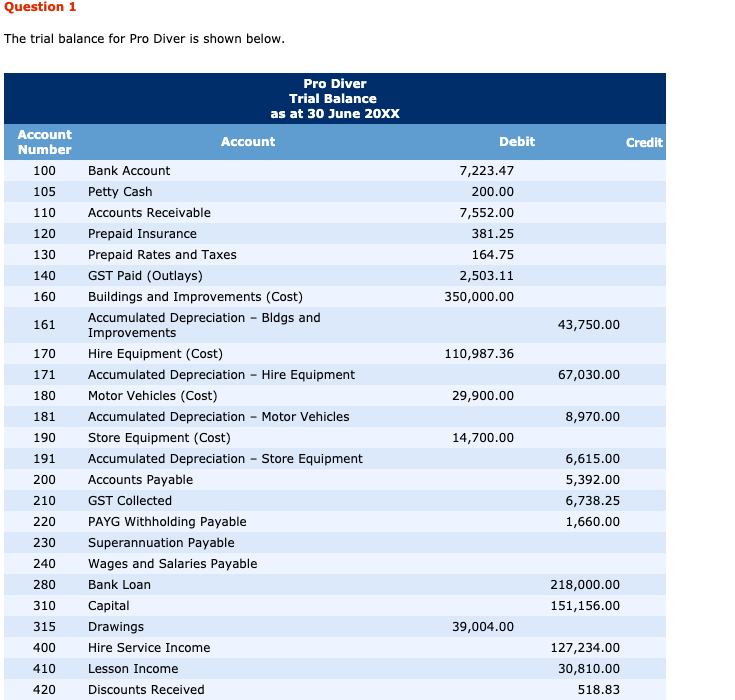

Solved Question 1 The Trial Balance For Pro Diver Is Shown Chegg Com

Prepare A Trial Balance Principles Of Accounting Volume 1 Financial Accounting

Apply The Results From The Adjusted Trial Balance To Compute Current Ratio And Working Capital Balance And Explain How These Measures Represent Liquidity Principles Of Accounting Volume 1 Financial Accounting