unlevered free cash flow vs fcff

There are two types of Free Cash Flows. It is the cash flow available to all equity holders and debtholders after all operating expenses capital expenditures and investments in working capital have been made.

Unlevered Free Cash Flow Definition Examples Formula

While unlevered free cash flow excludes debts levered free cash flow includes them.

. Leverage is another name for debt and if cash flows are levered that means they are net of interest payments. Real riskfree rate 12 Beta 117 X Risk Premium 923 Unlevered Beta for Sectors. Unlevered free cash flow vs.

18073 Equity 15158-Options 0 ValueShare 6157 Riskfree Rate. When would you use levered cash. Unlevered and Levered Free Cash Flow.

Therefore youll find that unlevered free cash flow is higher than levered free cash flow. Unlevered Free Cash Flow also known as Free Cash Flow to the Firm or FCFF for short is a theoretical cash flow figure for a business. Free Cash Flow vs.

Interest debt payments are part of the free cash flow formula calculation as interest expense. Status Quo in Rs Reinvestment Rate 60 Return on Capital 920 Term Yr 6079. The difference between levered and unlevered FCF is that levered free cash flow LFCF subtracts debt and interest from total cash whereas unlevered free cash flow UFCF leaves it in such that LFCF Net Profit DA ΔNWC CAPEX Debt and UFCF.

Levered free cash flow assumes the business has debts and uses borrowed capital. Unlevered Free Cash Flow is used in financial modeling to determine the enterprise value of a firm. Unlevered free cash flow is known as free cash flow to firm.

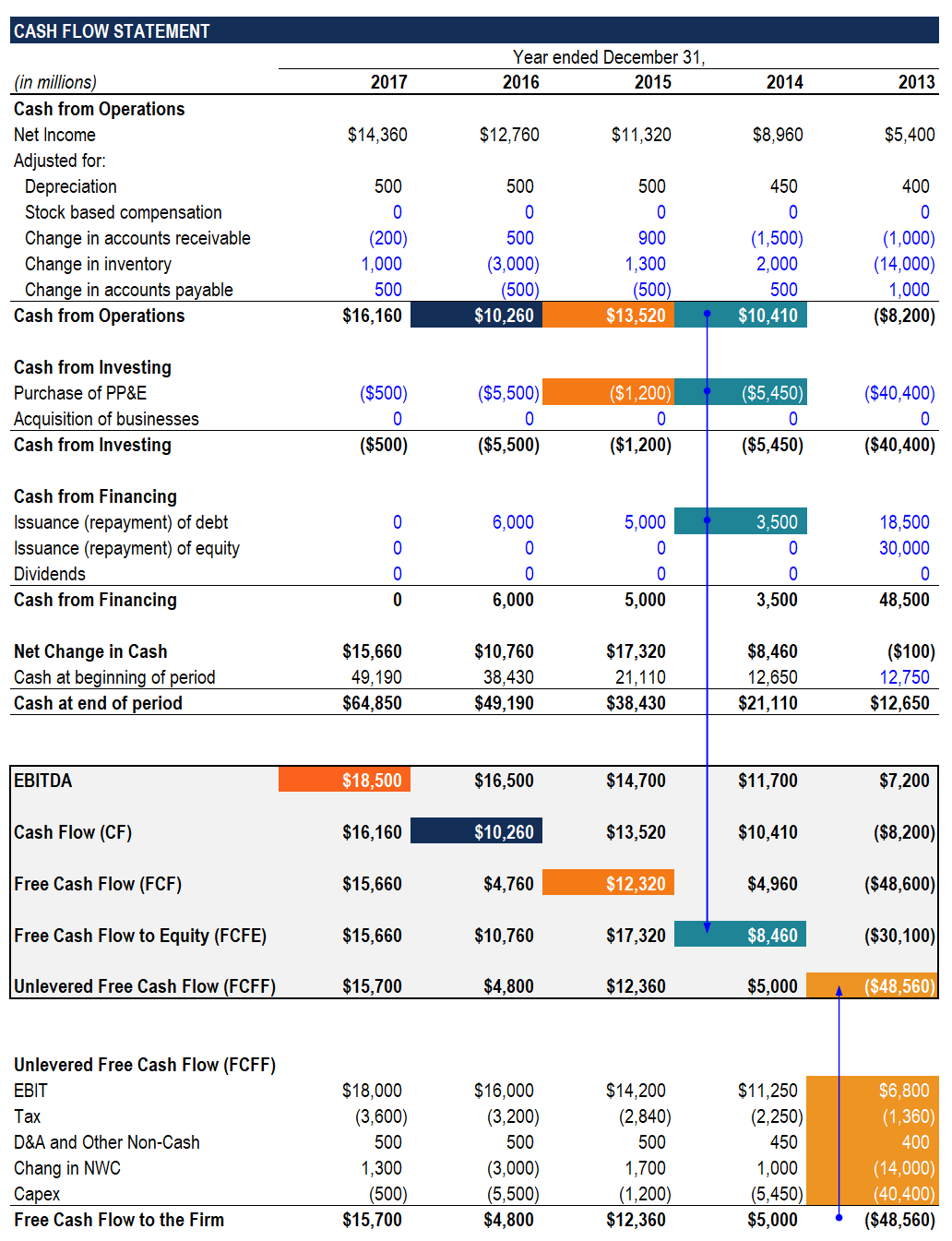

What is Unlevered Free Cash Flow. Unlevered Free Cash Flow also known as Free Cash Flow to the Firm or FCFF for short is a theoretical cash flow figure for a business assuming the company is completely debt-free and thus has no interest expense. FCFF EBIT - Taxes Depreciation Amortization - Change in Working Capital - Capital Expenditure.

Used interchangeably with unlevered free cash flow the FCFF metric accounts for all recurring operating expenses and re-investment expenditures while excluding all outflows related to lenders such as interest expense payments. FCFF is a hypothetical figure an estimate of what it would be if the firm was to have no debt. Free Cash Flow to the Firm or FCFF also called Unlevered Free Cash Flow requires a multi-step calculation and is used in Discounted Cash Flow analysis to arrive at the Enterprise Value or total firm value.

Unlevered free cash flow is the gross free cash flow generated by a company. Equity FCF EFCF is the FCF that is made available for the equity shareholders of the company. Free cash flow to the firm is synonymous with unlevered free cash flow.

Unlevered FCF is FCF to the enterprise ie the firm. As reported in the companys 10. Below is the cash flow statement for Apple Inc.

79 Mature risk premium 4 Country Risk Premium 523 Tube Investments. Youll learn about metrics and multiples based on cash flow in this lesson and youll understand how each of them is subtly different from the othersBy htt. Free cash flow FCF on the other hand is the money a company has left.

DCF Implications for Both. It is the cash flow available to all equity holders and debtholders after all operating expenses capital expenditures and investments in working capital have been made. FCFF is not the same as CFO - CAPEX because Cash from operations starts with net income instead of NOPAT where NOPAT net operating profit after taxes is EBIT 1 - t.

Unlevered Free Cash Flow also known as Free Cash Flow to the Firm or FCFF for short is a theoretical cash flow figure for a business. Unlevered free cash flow UFCF is the amount of available cash a firm has before accounting for its financial obligations. On the other hand if the cash flow metric is levered free cash flow then the matching valuation metric would be the equity value.

Free Cash Flow to the Firm FCFF is an indicator of the ability of a company of producing cash for capital expenditure. FCFF is known as unlevered free cash flow. Levered free cash flow.

If the cash flow metric used as the numerator is unlevered free cash flow the corresponding valuation metric in the denominator is enterprise value TEV. Unlevered vs Levered FCF Concept Review. Unlevered free cash flow or just FCF is different from levered free cash flow because unlevered free cash flow does not account for debt principal payments.

Operating Cash Flow Examples. Difference between FCFF vs FCFE The key difference between Unlevered Free Cash Flow and Levered Free Cash Flow is that Unlevered Free Cash Flow excludes the impact of interest expense and net debt issuance repayments whereas Levered Free Cash Flow includes the impact of interest expense and net debt issuance repayments. Levered Free Cash Flow vs Unlevered Free Cash Flow.

Key Learning Objectives What is the formula to calculate unlevered free cash flow. 075 Firms DE Ratio.

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Free Cash Flow To Firm Fcff Formulas Definition Example

Free Cash Flow From Ebitda Calculation Of Fcff Fcfe From Ebitda

Free Cash Flow To Firm Fcff Formulas Definition Example

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Fcff Vs Fcfe Differences Valuation Multiples Discount Rates

Fcff Vs Fcfe Differences Valuation Multiples Discount Rates